Micron Technology said on Thursday it will invest an additional $30 billion in the domestic semiconductor industry, becoming the latest chipmaker to answer President Donald Trump’s call for bringing more investment to the United States.

The $200-billion plan includes building two high-volume semiconductor fabrication plants in Idaho and up to four more in New York. Micron said the Idaho plants allow the company to bring advanced high-bandwidth memory (HBM) manufacturing, which is critical to artificial intelligence (AI) developers in need of advanced computer memory, to the United States.

The plan also includes expanding and modernizing its existing facilities in Virginia, and funding research and development “to drive American innovation and technology leadership.”

“These investments are designed to allow Micron to meet growing market demand fueled by AI, maintain share and support Micron’s goal of producing 40 percent of its DRAM in the US,” Micron said, referring to dynamic random access memory, a key component of modern computers and servers.

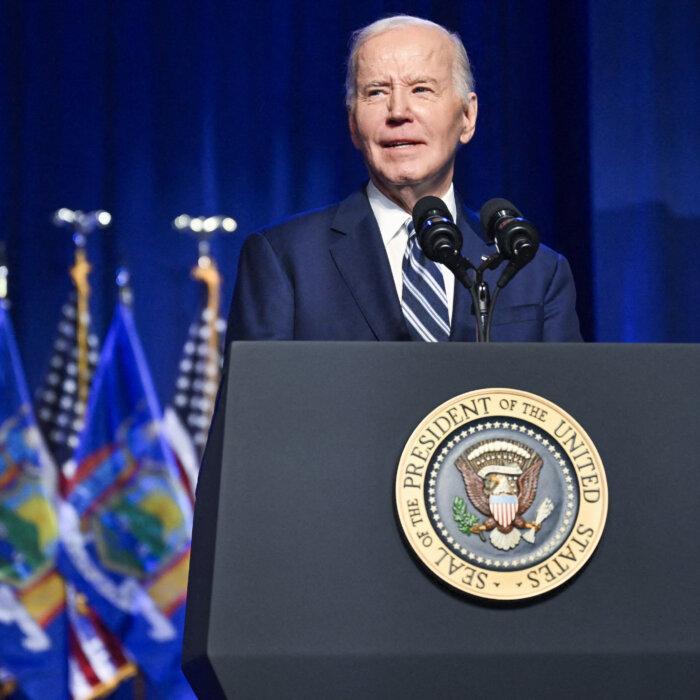

Major recipients of CHIPS Act funding include global chipmakers like Taiwan’s TSMC, South Korea’s Samsung and SK Hynix, and U.S.-based Intel and Micron. While the funding was approved under President Joe Biden, much of it had not been disbursed before he left office in January.

He highlighted a revised deal with TSMC, which was awarded $6.6 billion in direct federal funding under the CHIPS Act for a commitment to spend $65 billion to build three state-of-the-art factories in Arizona. In March, the Taiwanese company announced it would add $100 billion to its previous pledge, without any extra subsidies from the government.

During the hearing, Lutnick told lawmakers that he is pushing for funding levels that amount to 4 percent or less of a project’s total value, saying that the Biden administration was being “overly generous” with a 10 percent funding level.

“You will see that all the deals are getting better,” Lutnick told the lawmakers. “The only deals that are not getting done are deals that should have never been done in the first place.”

Headquartered in Boise, Idaho, Micron also maintains operations at four locations in Taiwan and is considered a major competitor to China’s leading memory chipmaker, Yangtze Memory Technologies Co. (YMTC).

In 2023, Chinese regulators launched a cybersecurity review of Micron and subsequently banned its products from use in critical infrastructure. The decision was widely seen as retaliation for U.S. actions that included banning the social video app TikTok on government phones and placing YMTC on the Commerce Department’s Entity List the previous year.