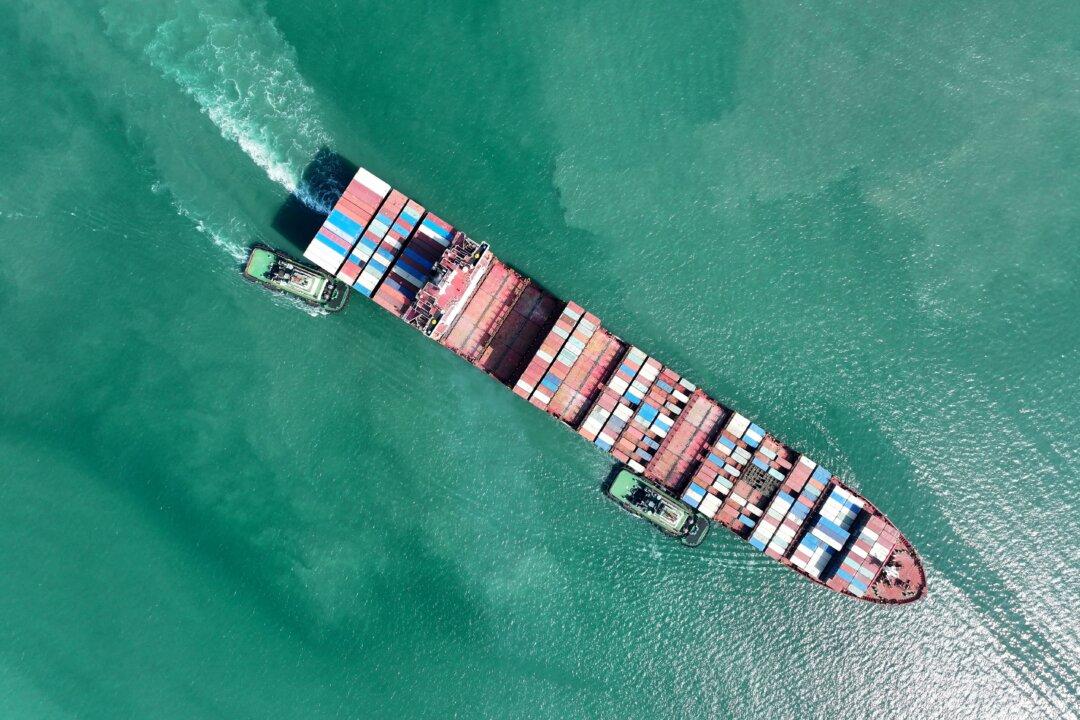

China’s exports grew at a slower-than-expected pace in May, with shipments to the United States suffering their steepest decline in more than five years, according to customs data released on June 9.

Shipments to the United States plummeted by 34.5 percent in dollar terms in May from a year earlier, according to The Epoch Times’ calculation of official data. The figure marks the largest monthly fall since February 2020, when the COVID-19 pandemic began to disrupt global supply chains.

“We could see import front-loading amid the still elevated risk that tariffs could once again move higher in light [of] the uncertainty about trade talks over the past month,” Song said.

He also mentioned that China’s acceleration of exports to countries outside the United States helped to prop up overall export figures.

Exports to the Association of Southeast Asian Nations surged by 14.8 percent in May from a year earlier, with countries like Thailand, Vietnam, and Indonesia seeing significant increases in imports from China.

Exports to Africa and the European Union remained strong, with year-on-year growth of 33 percent and 14.7 percent, respectively.

On the import side, China saw a 3.4 percent decrease in May compared to the previous year, which was sharper than the 0.9 percent decline analysts had expected.

Trade Talks

The latest official data were released just hours before a high-stakes meeting between senior trade and economic officials from China and the United States in London.Following their previous discussions in Geneva in May, both countries agreed to scale back the hefty tariffs they had imposed on each other.

Among the topics on the agenda for the latest round of bilateral trade negotiations is China’s rare earth export control, according to National Economic Council Director Kevin Hassett.

On June 7, the Chinese Ministry of Commerce stated that it had approved a number of licenses for rare earth export applications, without specifying which countries or industries received them.

According to The Epoch Times’s calculation of the latest customs data, the volume of China’s rare earth exports fell by 5.6 percent from the previous year.

The figures do not differentiate among the 17 rare earth elements, some of which are not on the export restriction list. The export control measures announced in April require exporters of seven rare earth metals—dysprosium, gadolinium, lutetium, samarium, scandium, terbium, and yttrium—to apply for special licenses for shipment.