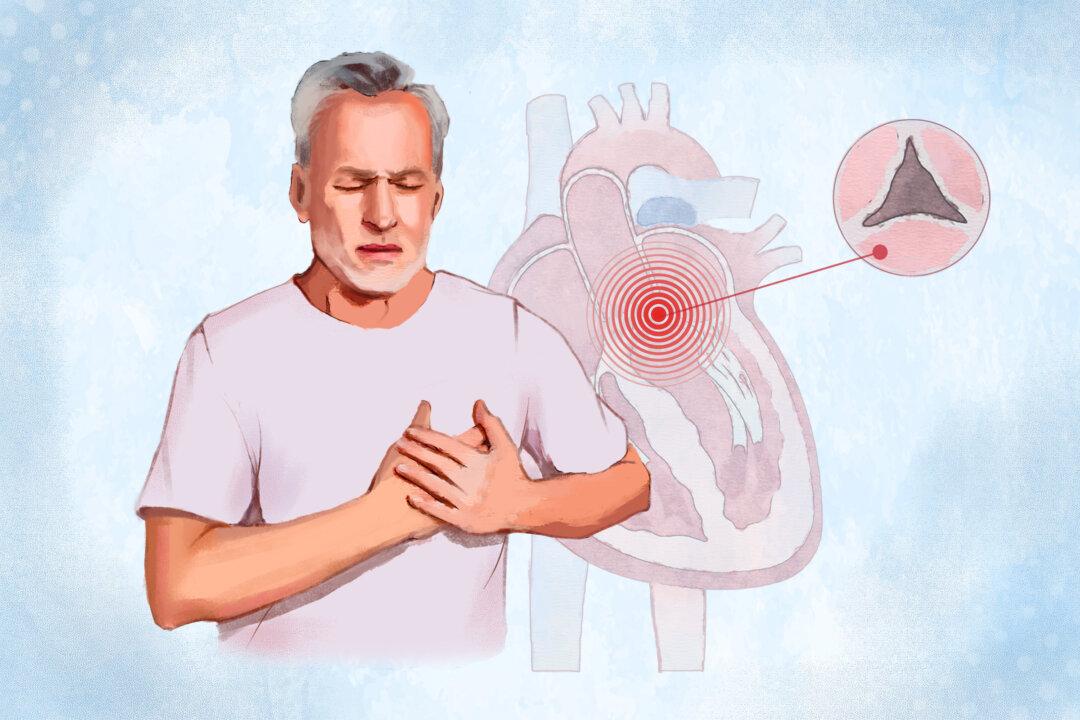

“AFib contributes to turbulent flow inside the heart. The irregularity of the blood flow allows for a pause in the blood flowing through the heart, allowing the blood to clot. This then can be sent to the brain[,] causing strokes,” Dr. Ken Perry, an emergency physician in Charleston, South Carolina, told The Epoch Times via email.

CMS Negotiations

According to a CMS factsheet, about 3.7 million Medicare Part D enrollees used Eliquis from June 2022 to May 2023. The total Part D gross covered prescription cost to Medicare for the same period was $16.5 billion.A CMS representative told The Epoch Times via email that “The IRA helps people who take anticoagulant medications through Medicare Negotiation. Any negotiated prices agreed to between Medicare and participating drug companies will be announced by September 1, 2024, and become effective beginning in 2026.”

Who Are the Pharmacy Benefit Managers?

Pharmacy benefit managers are often overlooked intermediaries between drug and insurance companies. Three major PBMs—CVS Caremark, Optum RX, and Express Scripts—account for approximately 80 percent of medication fulfillment in the United States. They play a central role in pricing drugs for insurers, deciding which drugs will be most accessible to consumers, and determining how much pharmacies are paid for these medications.“There is a misperception by the White House and patients that the problem is the drug companies. What they don’t realize is the pharma companies are over the barrel, just like we are,” Ms. Hills told The Epoch Times.

PBM Rebates

PBMs work on behalf of insurance companies, large employers, and government agencies. One of their main responsibilities is lowering drug costs for these organizations. They achieve this by negotiating rebates with drug manufacturers. The rebates are paid to the PBMs, who retain a portion of the savings and pass the remainder on to the insurance companies or employers.In exchange for rebates, PBMs include a drug on their formulary, the list of drugs that pharmacies offer. PBMs utilize a tiered system to manage these drugs. Medications with a higher tier typically have a lower patient copay, motivating drug companies to provide higher rebates in exchange for a favorable tier placement. PBMs can remove a drug from the formulary altogether, potentially limiting patient access to that drug.

PBMs and Drug Access

When PBMs have to pay more for a drug without receiving a substantial rebate from the drug manufacturer, it negatively affects their margins. According to the Alliance for Patient Access, the PBMs will sometimes remove the drug from their formulary, forcing patients to either pay the total price out-of-pocket or switch to a different drug that may be similar but not the one prescribed by their doctor.Ms. Hills said a similar situation happened in December 2021, when many patients received word that CVS Caremark was dropping Eliquis from its formulary. This allowed patients to either take another anticoagulant—rivaroxaban or warfarin—or pay the total out-of-pocket cost for Eliquis.

The American College of Cardiology and patient advocacy groups pressured CVS Caremark to reverse its decision. In July 2022, CVS Caremark reinstated Eliquis on its formularies, stating that the drug was re-added after securing a lower net cost from the drug manufacturer.

Nonmedical Drug Switching Risks

Nonmedical switching, especially with a medication like Eliquis, can be harmful to patients.“One of the problems is that patients taking Eliquis twice a day, switching to Xarelto (rivaroxaban), which is only taken once a day, could cause confusion and a potential overdose, putting them at risk for bleeding. When a patient is stable, they should be left on that medication,” Ms. Hills said.

“The stated approval criteria required that I first take and fail Xarelto or have another clinical indication, which was undefined,” Ms. Waldron wrote. “And if the exemption was approved, it would be at a higher coverage tier, making it subject to coinsurance and deductible. For me, this would mean an additional US$2400 a year.” The failure of Xarelto could also result in developing a potentially deadly blood clot.

According to Ms. Hills, when a medication is removed from the formulary and a patient is forced to switch medications, they can ask their doctor to submit a prior authorization to the insurance company stating the patient’s need for one medication over another. However, some patients don’t have time for the prior authorization process.

CMS Initiatives and Updates

The Epoch Times emailed CMS and asked if any stipulations would be in place to ensure that PBMs don’t interfere with Eliquis’ accessibility and pricing for Medicare beneficiaries and people with private insurance.CMS did not answer the question about PBMs. However, it did offer specific details about the IRA price negotiations and the Extra Help program, available for people with incomes up to 150 percent of the federal poverty level. The IRA has expanded eligibility for the program, which can lower premiums and reduce out-of-pocket costs for prescription drug coverage.

Ms. Hills said she recently received encouraging news from CMS. The agency has asked patients for comments about incorporating patient input into revising the negotiation process for the second round of talks with drug companies to ensure patient access to medications under Part D.

“Within that, there are two things they’re asking about,” said Ms. Hills. “No. 1 is considering concerns around patient access disruption under Part D due to the combination Part D redesign would lead to coverage restrictions.”

CMS also wants patient input about reviewing Part D sponsor formularies annually to evaluate and address instances where selected drugs are unfavorably placed on tiers or subjected to more restrictive utilization management than nonselected drugs in the same class. “CMS is actually recognizing that this is a problem, and they’re asking for input on it,” she said. “Apparently, they heard us.”

The pharmaceutical industry is currently engaged in a legal battle with the federal government, attempting to block the negotiations by alleging that the program violates federal law and is unconstitutional. Despite these efforts, negotiations are ongoing and are expected to continue until August 1. The maximum fair price for the first 10 drugs, including Eliquis, will be announced on Sept. 1 and will take effect at the beginning of 2026.