|

The Truth About Retail Sales |

|

|

By Jeffrey Tucker |

|

Commentary

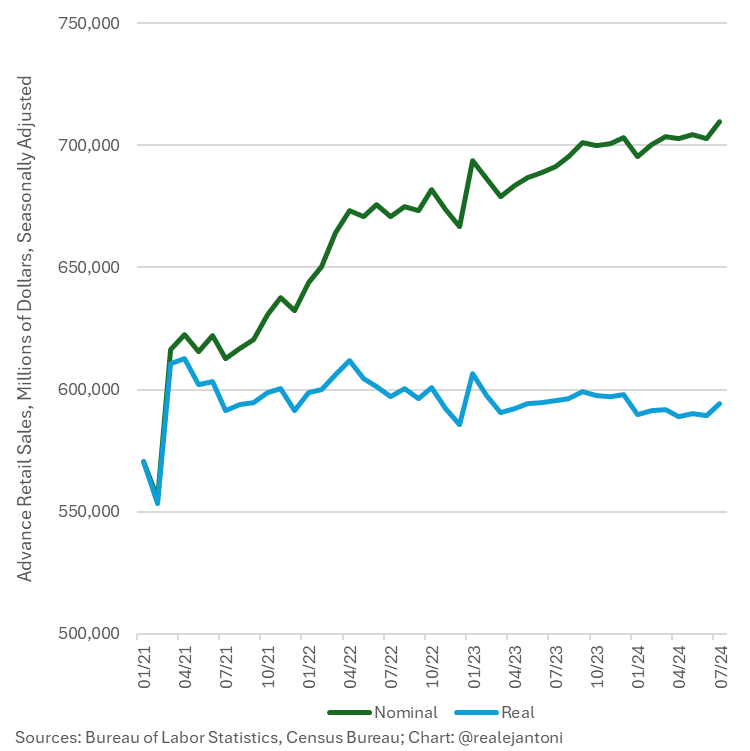

In normal times, a boost in retail sales would be something to cheer. It suggests that consumers are spending, producers are producing, and plenty of resources exist to support it. By normal times, I mean most of the past 40 years before three years ago. That’s because inflation at the time seemed manageable, running generally at about 2 percent per year. It never occurred to anyone that a boost in retail sales was nothing more than people spending more money on the same thing. Retail sales are typically reported in nominal terms; that is, just the amounts. In times of high inflation, however, this creates an odd situation. People have to spend more on the same good or service on repeated buys. You know this now from personal experience. What used to cost $1 is now $1.50 or $2. If the government reported the new spending as great news, you might protest: “That is not progress, and it certainly is not good news.” And yet, old habits die hard. Month after month, retail sales data are reported not in real terms but nominal ones. There are many features of government data today that deserve skepticism, but this one ranks up at the top. It is so brazenly misleading, and yet there is no official source out there that reports real retail sales. This is odd because no agency would report gross domestic product (GDP) numbers without adjusting them for inflation. And yet, for retail sales, such adjustments are never made. Or, rather, you have to make the adjustment yourself. My colleague E.J. Antoni is the great innovator here. He had the insight to adjust the sales by dollar depreciation. After all, if your weekly grocery bill went from $100 to $200, and then you had to start substituting cheaper products for more expensive ones, that would not be a good thing. And yet the agencies come along and say, "Hey look, sales are up." Antoni does the calculation using conventional inflation data, which is widely underreporting the numbers. It mangles housing prices, does not report housing insurance prices or interest rates, and dramatically underplays inflation in goods such as cars, groceries, and much more. And yet that is the data we have. What does he end up with? He wrote: “July advance retail sales estimate is 14.0 percent above Apr ’21, but down 3.0 percent in real terms over that same time—businesses are selling less stuff, but at much higher prices.” |

|

|

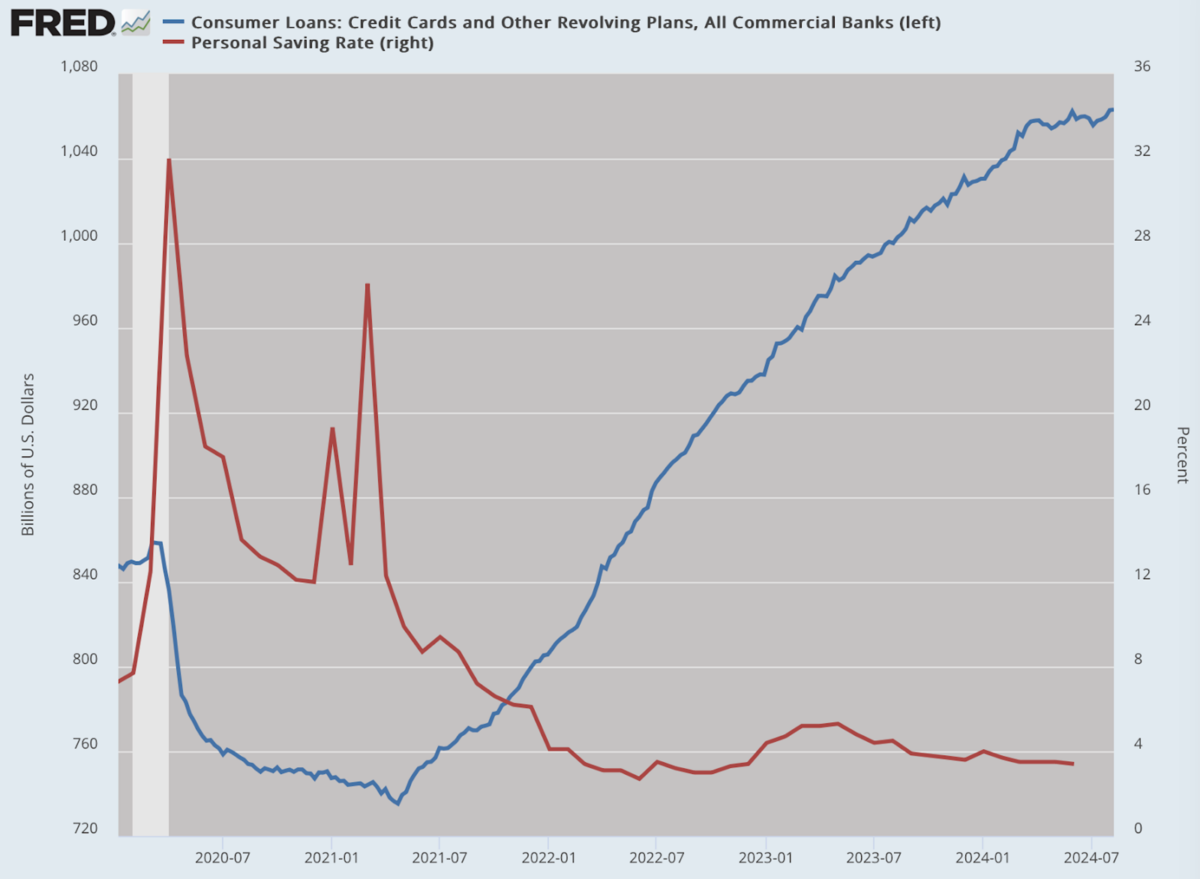

The difference is dramatic. By making this one adjustment, we can easily see that all of the increased sales over the past 3 1/2 years are illusory. It is simply you and I and everyone spending more on getting the same thing. That’s the best case. We are likely spending more on something worse. That is some astounding inflation and a grim reality. It only adds insult to injury to claim that this is all great news for economic growth! If you have followed the points so far, you might find yourself in the position I’m in often these days: a kind of disbelief that we are so often served up such nonsense. It is so obviously false, and that raises the question of why people believe it. In particular, why does Wall Street in general believe these numbers when corrected numbers make so much more sense? The answer grants no confidence: People believe it because they believe that other people believe it. The data reporting of our times, however, has created a highly fragile version of truth simply because it has no basis in reality. The savings rate is running extremely low, and credit card debt is at record highs. This has all happened in the course of a few years. It creates a candle burning at both ends. |

|

|

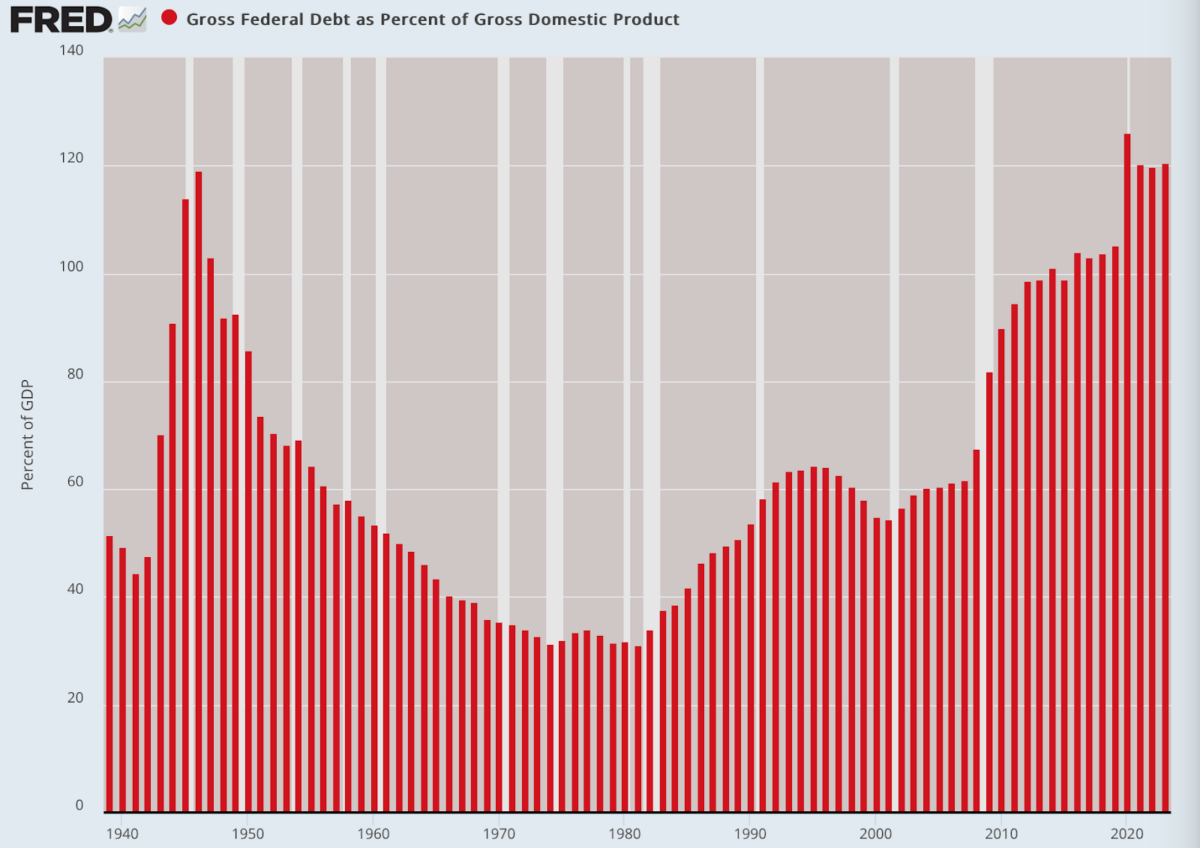

The reporting on retail sales helps mask the underlying reality. It’s the same with factory orders and wholesale inventories. They are reported but never adjusted by purchasing power except by a handful of dissident economists who are not afraid of the truth. When I’ve explained this whole situation to friends of mine, of any political persuasion, they are always amazed. We are rather used to thinking of government economic reporting as credible and more-or-less accurate, certainly not deliberately misleading. And truly, the strategy of reporting nominal terms worked for decades. Recent trends have changed everything. There is no sense in pretending that inflation has no broader effect on our perceptions of where we are in the business cycle. There are deeper theoretical problems associated with our constant focus on demand instead of supply. The habit developed in the 1930s when the prevailing theory of why the Depression persisted was that aggregate demand was too low. It was at this time that experts came to believe that government itself could operate as a viable replacement for private savings and investment, so long as the public remained sufficiently fired up and willing to spend rather than save money. All these years later, one might hope that we have dispensed with such nostrums, but it appears not. Even now, government spending is widely regarded as a benefit to overall output rather than a net cost. That is why government spending is included in the plus side of the ledger for GDP. Once again, this is just a habit, and nothing seems to change it, even though this has distorted economic data for generations. We are living through a time of astonishing growth in government, so much so that the debt-to-GDP ratio now compares to World War II. We’ve never seen anything like this in our times. That accounts for why a recession has not already been declared even though the signs are all around us. |

|

|

I would like to see some legislation or some executive action on this topic, something to give us better data so that we could know with greater assurance precisely where we are in the business cycle, know more about inflation, and have a better understanding of exactly how much prosperity we are losing thanks mostly to government intervention. If we do not have the data, we are condemned to languish in an epistemic void, which is precisely where we are today. I leave you with the following. You know how much your grocery bills, rent, and all other expenses have gone up over three years. Consider that the data markers followed by the financial markets all consider your higher expenses as bullish and good news all around. That is pathetically untrue. It would be nice for a return to some degree of honesty. |

|

|

|

Thank you for being a subscriber Your Feedback We may feature an excerpt of your response in the next newsletter. |

|

|

|